In Income Tax return form for Assessment year 2015-16 ,in tds (tax deducted at sources) schedule-2 a TDS other than salary a column regarding Unique TDS certificate number has been provided .This column is given in all the ITR in TDS schedule-2 for tax deducted other than salary income .However this field is not given under Details for Tax deducted at Source from Salary.

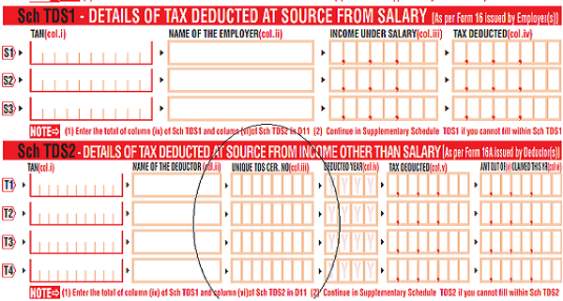

To Get an idea ,what we are saying, TDS Abstract from ITR-1 is given in the Picture given below.

To Get an idea ,what we are saying, TDS Abstract from ITR-1 is given in the Picture given below.

Now there are basically four questions related to Unique TDS certificate number

- what is Unique TDS certificate number.?

- From where I can get Unique Tds Certificate number ?

- whether it is mandatory to Be filled ?

- what if we don't fill the Unique TDS certificate Number in the return?

1. What is the Unique TDS certificate Number.: CBDT has issued Circular 03/2011 on May 13, 2011,detailing new procedure of Issuance of TDS Certificates in Form No. 16A for Tax deducted on or after 01.04.2012 under which companies and Banks were directed to download Form 16A from TIN Web Site and issue such downloaded certificates to deductees.For other deductors, it was optional to download Form 16A from TIN Web site ,However later Form 16(non salary TDS) and Form 16 (Part-A)(salary TDS) to be issued mandatory through download from TDSCPC website wef fy 2012-13 (circular 04/2013 dated 17.04.2013)

TDS certificate downloaded from TDS CPS (traces) website have a six to eight digit number in alphabets which is referred as unique TDS Certificate Number.

2. From where I can get Unique Tds Certificate number ?

As explained above it is mandatory to download Form 16A/16 by all type of deductors .If You have received Form 16A/16 without bearing Unique TDS certificate Number then request deductor to issue Form Downloaded from TDS CPS (traces).

Unique TDS number is shown both on Form 16 and Form 16A ,however in case of tds on salary(form -16) no such column is provided in Income Tax return form .

Example of Unique TDS certificate Number in Form 16A (you may find on Top of certificate or in fourth-fifth line of TDS certificate .

Example of Unique TDS certificate Number in Form 16A (you may find on Top of certificate or in fourth-fifth line of TDS certificate .

3. Whether it is mandatory to fill Unique TDS certificate Number ?

It is not mandatory to Fill Unique TDS certificate number in Income Tax return Form . You may fill Unique Tds certificate number wherever available.This has also been suggested in E filing utilities issued by the Income Tax department in excel . Column with heading in red color is only mandatory to be filled in Income Tax return whereas column heading for Unique TDS certificate number is given in Black color.In ITR e filing utility comment is shown as under.

"Please enter 8 character,and in case the unique TDS certificate no is 6 or 7 characters , you need not prefix any zeros"

"Please enter 8 character,and in case the unique TDS certificate no is 6 or 7 characters , you need not prefix any zeros"

4. What if we don't fill the Unique TDS certificate Number in the return?

Unique TDS certificate number is not mandatory in income tax return as of now .So there is no direct effect on your income tax return or on your refund if you do not provide the Unique TDS certificate number in income Tax return.

Our advice to all readers that if you are not sure about Unique TDS certificate number then leave blank the column as filing wrong number may lead to wrong processing of return.

Our advice to all readers that if you are not sure about Unique TDS certificate number then leave blank the column as filing wrong number may lead to wrong processing of return.

No comments:

Post a Comment